Financial literacy is an essential skill for anyone who wants to make smart choices about money. Whether you’re managing your own finances, starting a business, or planning for retirement, understanding the basics of personal finance can help you achieve your goals and avoid common financial pitfalls. Here are some key topics to help you become financially literate:

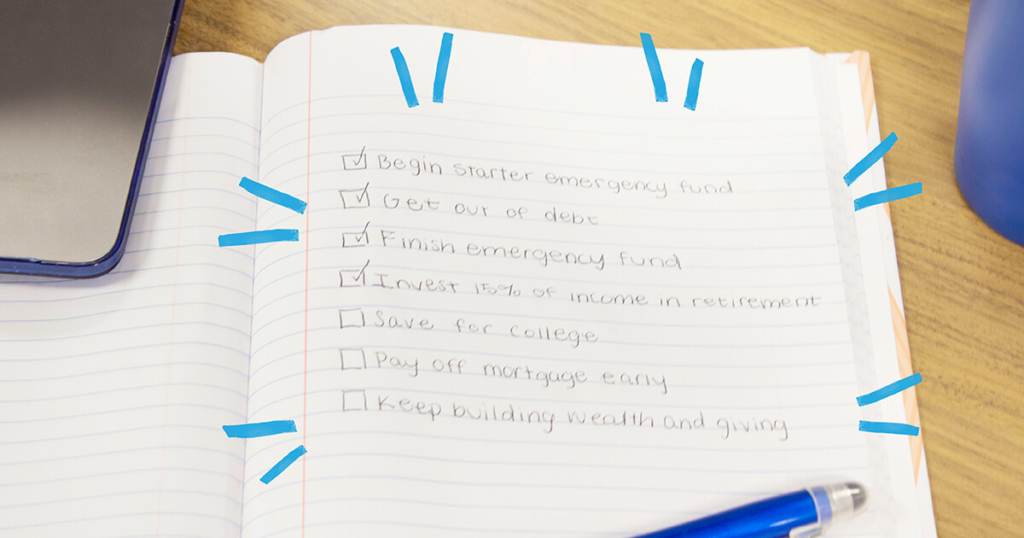

- Budgeting: Learn how to create a budget and track your expenses to make sure you’re living within your means.

- Saving: Learn about different types of savings accounts and investment options, and create a plan to save for your short-term and long-term goals.

- Credit: Understand how credit works, how to build a good credit score, and how to use credit responsibly.

- Insurance: Learn about different types of insurance and how to protect yourself from financial losses.

- Investing: Learn about different types of investments, such as stocks, bonds, and mutual funds, and how to create an investment plan that aligns with your goals and risk tolerance.

- Retirement planning: Learn about different retirement accounts, such as 401(k)s and IRAs, and how to create a plan to save for retirement.

- Taxes: Understand how taxes work and how to prepare and file your taxes.

By educating yourself on these topics, you can make informed decisions about your finances and achieve greater financial stability and security.